Loan interest rates can be confusing — fixed vs. variable, APR vs. interest rate, credit score impact, lender requirements…

But the truth is: your interest rate determines how expensive your loan truly is. Even a 1–2% difference can save (or cost) you thousands of dollars.

This guide breaks down how loan interest rates really work and gives you proven strategies to lower your rate before you apply.

What Is a Loan Interest Rate? (In Simple Terms)

A loan interest rate is the fee you pay the lender for borrowing money.

It’s expressed as a percentage of your loan amount (the principal).

Example:

Borrow $10,000 at 10% interest → You pay $1,000 per year in interest (simplified version).

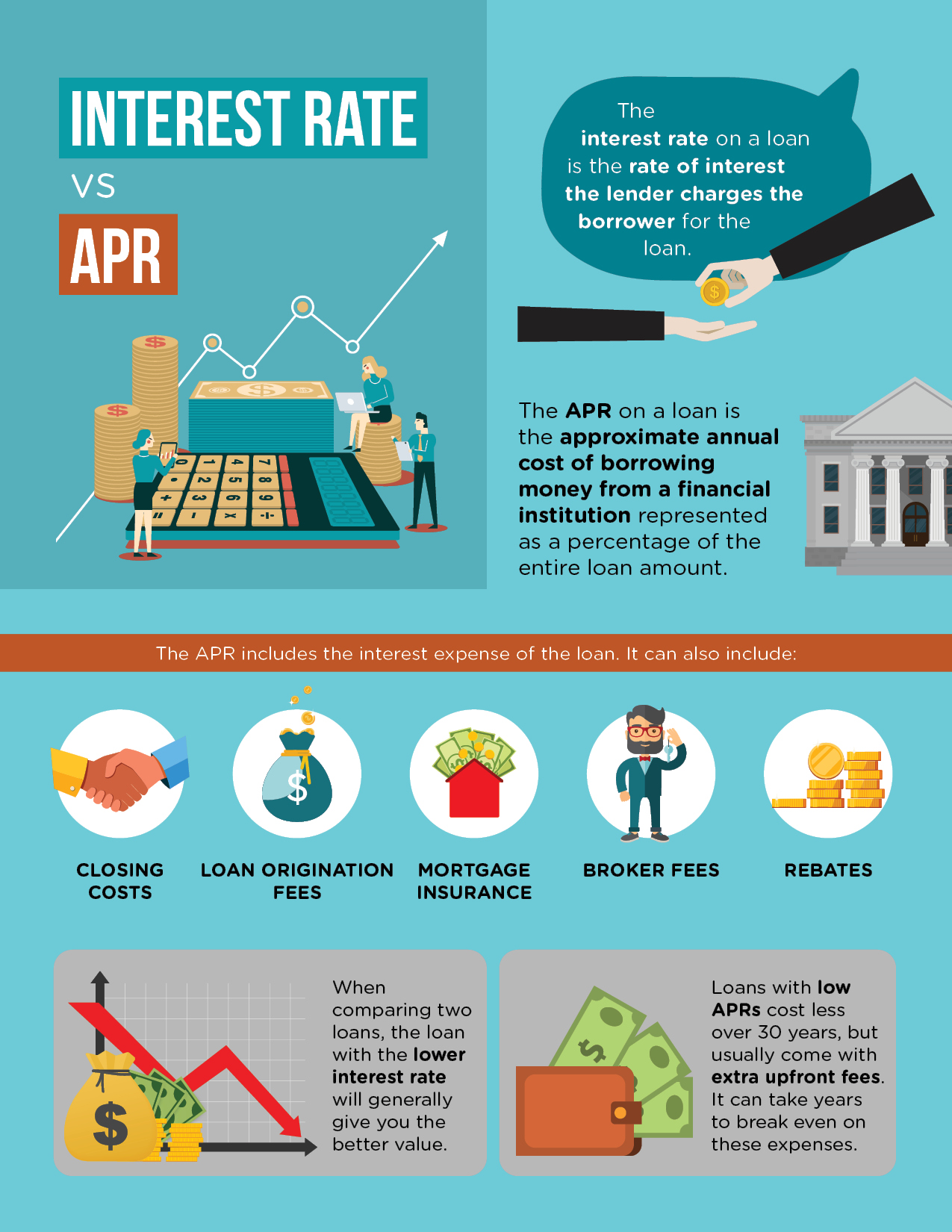

APR vs. Interest Rate — What’s the Difference?

Interest Rate

➡️ The cost of borrowing the principal only.

APR (Annual Percentage Rate)

➡️ The true cost of the loan — includes interest AND all fees (origination, underwriting, etc.)

Always compare loans by APR, not interest rate.

Fixed vs. Variable Interest Rates

Fixed Rate

- Stays the same for the entire loan

- Predictable monthly payments

- Common for mortgages, auto loans

Variable Rate

- Changes with market conditions

- Low at first, but can increase

- Common for HELOCs, some personal loans, credit cards

Tip: Choose fixed if you prefer certainty. Choose variable only if you expect rates to drop.

What Affects Your Loan Interest Rate?

Here are the biggest factors lenders use to determine your rate:

1. Your Credit Score

The #1 factor influencing interest rates.

- Excellent credit → lowest rates

- Poor credit → highest rates

A difference of 50–70 points can change your rate by several percentage points.

2. Your Income & Employment Stability

Lenders want consistent earnings.

Stable income = lower risk = better rates.

3. Debt-to-Income Ratio (DTI)

DTI = percentage of monthly income that goes to debt.

Lower DTI → Better odds of a low-interest rate.

Aim for:

- Below 36% = ideal

- 36–43% = acceptable

- 43%+ = high risk

4. Type of Loan

Different loans have different average interest levels:

- Mortgages → low

- Auto loans → low–medium

- Personal loans → medium

- Credit cards → very high

- Payday loans → extremely high (avoid)

5. Loan Term Length

Shorter terms = lower rates

Longer terms = higher rates

Example:

- 36-month personal loan → lower rate

- 84-month personal loan → higher rate

6. Collateral (For Secured Loans)

If you pledge collateral (car, home, assets), lenders reduce your rate because their risk is lower.

How to Lower Your Loan Interest Rate

Here are proven strategies lenders actually pay attention to:

1. Improve Your Credit Score Before Applying

Raising your score by even 20–30 points can lower your rate dramatically.

Ways to boost your score fast:

- Pay down credit card balances

- Avoid new credit inquiries

- Remove errors from your credit report

- Pay all bills on time for 3–6 months

2. Shop Around — Don’t Take the First Offer

Different lenders offer very different rates.

Compare:

- Banks

- Credit unions

- Online lenders

- Peer-to-peer lenders

Tip: Use “soft pull” prequalification to avoid damaging your score.

3. Lower Your Debt-to-Income Ratio

Quick ways to lower DTI:

- Pay off small debts first

- Refinance high-payment loans

- Increase income (side jobs, overtime)

Lower DTI = lower risk = lower rates.

4. Increase Your Down Payment (Secured Loans)

More money upfront reduces your rate because the lender’s risk goes down.

General recommendation:

- Auto loans → 10–20% down

- Mortgages → 5–20% down

5. Use Collateral If You’re Comfortable With It

Secured loans offer significantly lower rates.

Common collateral includes:

- Vehicles

- Real estate

- Savings accounts

- Certificates of deposit (CDs)

6. Choose a Shorter Loan Term

Short-term loans usually come with lower rates, plus you pay less interest overall.

7. Apply With a Co-Signer

A strong co-signer can help you:

- Qualify more easily

- Get a lower rate

- Borrow a higher amount

8. Develop a Healthy Banking Relationship

Some institutions offer:

- Loyalty discounts

- Better rates for existing customers

- “Relationship pricing” when you keep accounts with them

9. Avoid Applying During Economic Rate Spikes

Interest rates rise and fall based on:

- Inflation

- Monetary policy

- Economic stability

If possible, borrow during low-rate market conditions.

Final Thoughts

Interest rates aren’t random — lenders use a clear set of criteria to decide your rate and loan cost.

Understanding these factors and using the strategies above can save you thousands of dollars over the life of a loan.

Here’s the truth:

A low interest rate isn’t luck — it’s preparation.

Improve your credit, compare lenders, reduce your debt, and position yourself as a low-risk borrower. You’ll be rewarded with better rates and lower long-term costs.