Getting approved for a loan isn’t just about filling out an application — lenders follow strict criteria to decide who qualifies and at what interest rate.

This guide reveals practical, insider-style tips lenders use when evaluating borrowers, so you can dramatically increase your chances of approval.

1. Know Your Credit Score Before You Apply

Your credit score is one of the biggest factors lenders review.

Why it matters:

- Determines interest rate

- Affects approval

- Impacts loan amount

What lenders consider “good”:

- 720+ → Excellent (best rates)

- 670–719 → Good

- 580–669 → Fair

- Below 580 → Poor (high risk)

Insider Tip:

Lenders often have hard minimum credit score requirements. If you’re below it, they can’t approve you even if other factors look good.

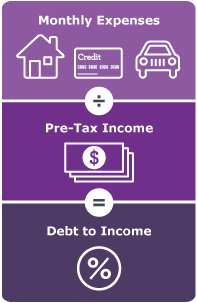

2. Lower Your Debt-to-Income (DTI) Ratio

Your DTI ratio compares your monthly debt payments to your monthly income.

It helps lenders see if you can handle more debt.

Target DTI for approval:

- Below 36% → Ideal

- 36–43% → Acceptable

- 43%+ → High risk of denial

How to lower your DTI quickly:

- Pay off small balances

- Refinance high monthly payments

- Avoid taking on new debt before applying

Insider Tip:

Some lenders will approve borderline applications if they see a recent decrease in debt.

3. Gather Required Documents Before Applying

Being organized signals reliability.

Common documents lenders want:

- Government ID

- Proof of income (pay stubs, tax returns)

- Bank statements

- Employment verification

- Proof of address

- List of current debts

Insider Tip:

Incomplete applications are one of the top reasons for slow approvals or rejections.

4. Avoid Hard Credit Inquiries Before Your Loan Application

Every loan, credit card, or finance inquiry creates a hard pull, which temporarily lowers your score.

Avoid these for 60–90 days before applying:

- New credit cards

- Store financing

- Auto loan shopping

- BNPL (“Buy Now Pay Later”) accounts

Insider Tip:

Lenders interpret recent credit activity as financial stress.

5. Maintain Steady Employment

Lenders prefer applicants with predictable income.

They look for:

- 2+ years at your current job or in the same field

- Stable or increasing income

- No recent job gaps

If you changed jobs recently:

Provide offer letters and proof of salary to strengthen the file.

Insider Tip:

Self-employed borrowers often need extra documentation — usually 2 years of tax returns.

6. Increase Your Down Payment (If Applicable)

For mortgages, auto loans, or secured loans, a higher down payment reduces lender risk.

Benefits:

- Higher approval chances

- Lower interest rates

- Lower monthly payments

General guideline:

- Auto: 10–20% down

- Mortgage: 5–20% down

- Secured personal loans: Depends on collateral value

7. Apply With the Right Lender for Your Profile

Not all lenders are the same.

Types of lenders to consider:

- Banks → strict but lowest rates

- Credit unions → flexible & member-friendly

- Online lenders → fast approvals & moderate requirements

- Peer-to-peer lenders → credit-flexible

- Specialty lenders → designed for low-credit borrowers

Insider Tip:

Applying to the wrong type of lender is one of the most common reasons people get denied.

8. Consider Adding a Co-Signer

A co-signer with strong credit can:

- Increase approval odds

- Lower interest rates

- Boost loan amount available

What lenders look for in co-signers:

- High credit score

- Low DTI

- Stable income

9. Start With a Prequalification (Soft Check)

Many lenders offer soft-credit prequalification, which won’t hurt your score.

Benefits:

- See potential rates

- Check approval odds

- Compare lenders safely

Insider Tip:

Prequalification isn’t guaranteed approval, but it helps you avoid wasted hard inquiries.

10. Explain Any “Red Flags” Upfront

Some borrowers get approved simply because they proactively provide explanations such as:

- Past late payments

- A temporary income drop

- Recent large deposits

- Credit report mistakes

Lenders appreciate transparency and may override automated declines when documentation supports your case.

Final Thoughts

Getting approved for a loan isn’t luck — it’s preparation.

By improving your credit, lowering your DTI, organizing documents, and choosing the right lender, you dramatically increase the chance of hearing “You’re approved.”