Launching or growing a business requires capital — and for many entrepreneurs, that means applying for a small business loan. But understanding how these loans work, what lenders look for, and how to qualify can feel overwhelming.

This guide breaks everything down in simple, practical terms so you can choose the best financing option with confidence.

What Is a Small Business Loan?

A small business loan is a sum of money borrowed by a business and repaid over time with interest. These loans can help with:

- Purchasing equipment

- Funding inventory

- Hiring staff

- Expanding operations

- Covering cash-flow gaps

Small business loans come from banks, online lenders, credit unions, and government-backed programs like the U.S. Small Business Administration (SBA).

Types of Small Business Loans

Different loans fit different business needs. Here are the most common options.

1. SBA Loans

SBA loans are partially guaranteed by the government, making them lower-risk for lenders and more accessible for business owners.

- Low interest rates

- Long repayment terms

- Strict qualification criteria

- Popular programs: SBA 7(a), 504, Microloans

Best for: Businesses needing large, affordable financing.

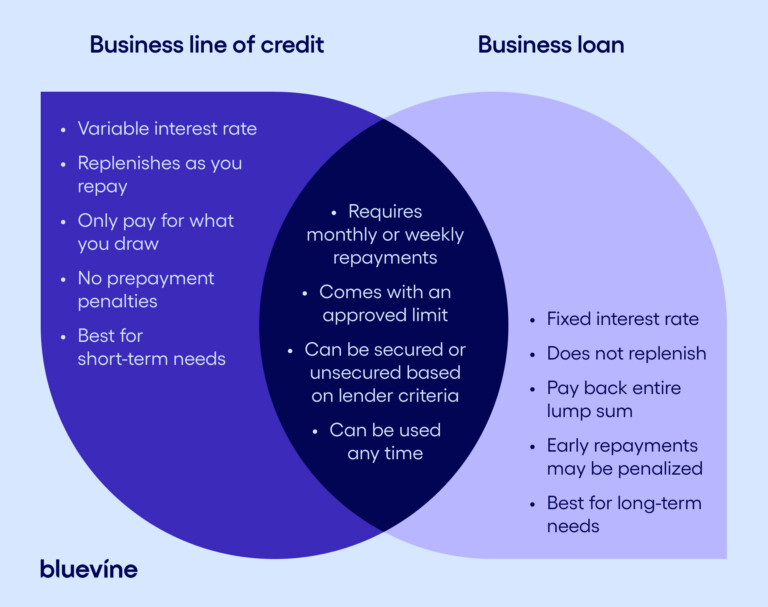

2. Business Term Loans

Traditional loans with fixed interest rates and predictable monthly payments.

- Amounts often range from $10,000 to $5M

- Can be short-term or long-term

Best for: Expansion, renovations, or major investments.

3. Business Lines of Credit

Working similarly to a credit card, you borrow only what you need.

- Flexible access to funds

- Interest only on what you use

- Great for cash-flow management

Best for: Seasonal businesses or ongoing operating costs.

4. Equipment Financing

A loan used specifically to purchase equipment; the equipment itself acts as collateral.

Best for: Restaurants, manufacturers, contractors, and any business requiring heavy equipment.

5. Invoice Financing

Borrowing against unpaid invoices to improve cash flow.

Best for: Businesses waiting on slow-paying clients.

How Small Business Loan Approval Really Works

Lenders evaluate risk before giving out money. Here are the main factors they consider:

1. Credit Score

Both personal and business credit matter.

Higher scores mean lower interest rates.

2. Time in Business

Most lenders prefer at least 1–2 years of operating history.

3. Revenue & Cash Flow

You’ll need documentation showing your ability to repay.

4. Collateral

Some loans require assets to secure the loan (such as property or equipment).

5. Business Plan

Particularly for startups, lenders want to see a clear strategy for using the funds.

Required Documents

Here’s what you’ll typically need:

- Business financial statements

- Tax returns (business & personal)

- Bank statements

- Business plan

- Legal documents (licenses, incorporation papers)

- Accounts receivable/payable reports

Having these ready speeds up approval dramatically.

Where to Get a Small Business Loan

You have several options, each with pros and cons.

1. Banks & Credit Unions

- Lower interest rates

- More documentation required

- Longer approval process

2. Online Lenders

- Fast approval (often 24–72 hours)

- Higher interest rates

- Great for short-term financing

3. SBA-Approved Lenders

Offer access to the most affordable, government-backed loan options.

Pros and Cons of Small Business Loans

✅ Pros

- Access to capital for growth

- Predictable repayment schedules

- Can build business credit

- Lower-cost financing compared to credit cards

❌ Cons

- Requires strong financial documentation

- May require collateral

- Interest accrues over time

- Approval can take weeks for traditional lenders

How to Choose the Right Loan

Use this quick checklist:

✔ Why do you need the funds?

✔ How fast do you need the money?

✔ Can you afford monthly payments today and in the future?

✔ Do you have collateral?

✔ Do you meet minimum credit and revenue requirements?

Final Thoughts

Small business loans can be powerful tools for scaling your business — if you choose the right type and lender. By understanding your financial needs, preparing documentation, and researching options, you can secure funding that fuels long-term success.