Choosing the right loan can feel overwhelming—especially when there are so many options available. Each type of loan serves a different purpose, comes with different costs, and fits certain financial situations better than others.

This guide breaks down the 7 most common types of loans, how they work, and how to decide which one is right for you.

1. Personal Loans

Best for:

✔ Debt consolidation

✔ Medical bills

✔ Big purchases

✔ Emergencies

✔ Travel or events

How they work:

Personal loans are usually unsecured, meaning you don’t need collateral. You borrow a fixed amount and repay it in monthly installments over 1–7 years.

Pros:

- Flexible use

- Fast approval

- No collateral required

Cons:

- Higher interest if you have poor credit

- Fixed repayment schedules

2. Auto Loans

Best for:

✔ Buying a new or used vehicle

How they work:

Auto loans are secured loans, meaning the car itself is the collateral. If you don’t pay, the lender can repossess the car.

Pros:

- Lower interest rates

- Longer repayment terms (3–7 years)

Cons:

- Car depreciation

- You may owe more than the car’s value over time

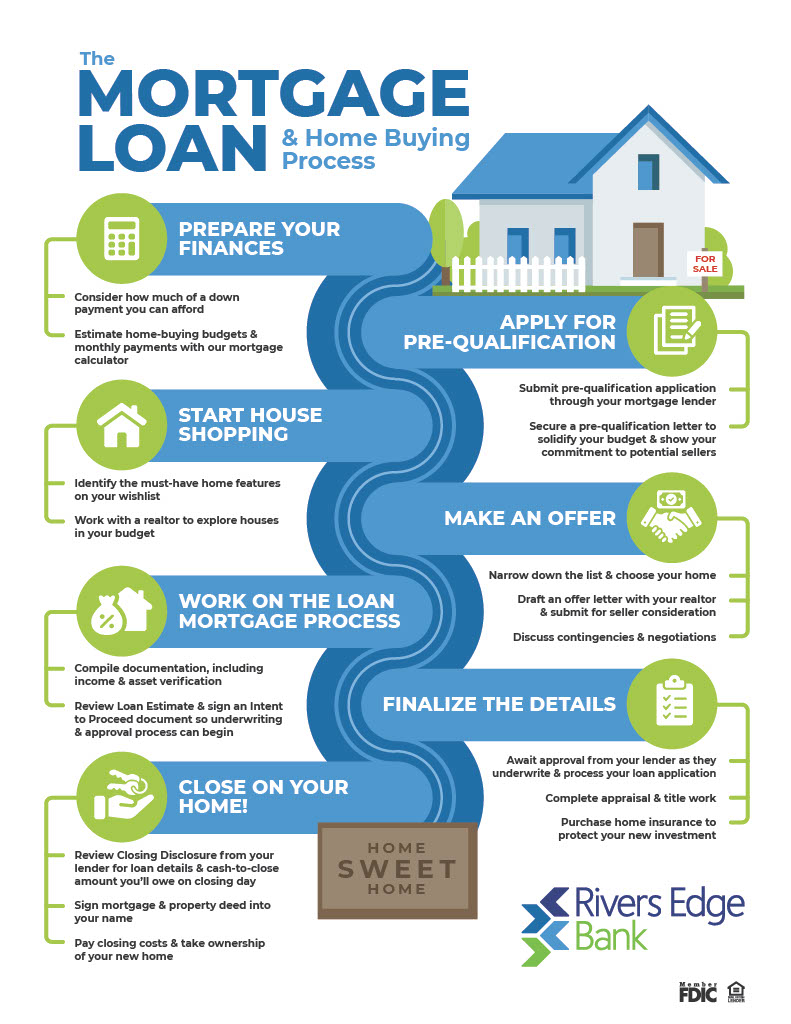

3. Mortgage Loans

Best for:

✔ Buying a home

✔ Refinancing existing home loans

How they work:

Mortgages are long-term loans (15–30 years) secured by the home you buy. Common types include conventional, FHA, VA, and jumbo loans.

Pros:

- Lowest interest rates of all major loans

- Long repayment terms

Cons:

- Requires good credit

- Large down payments often needed

- Risk of foreclosure

4. Student Loans

Best for:

✔ Paying for college, university, or trade school

How they work:

Student loans can be federal (government-backed) or private. Federal loans usually have better rates and protections.

Pros:

- Lower rates for federal loans

- Flexible repayment (income-based options)

- No credit required for most federal loans

Cons:

- Private loans may be expensive

- Long repayment periods

5. Business Loans

Best for:

✔ Starting or expanding a business

✔ Equipment purchases

✔ Cashflow needs

How they work:

Business loans include term loans, SBA-backed loans, lines of credit, and equipment financing.

Pros:

- Builds business credit

- Helps with large investments

Cons:

- Requires strong documentation

- Higher rejection rates for startups

6. Home Equity Loans & HELOCs

Best for:

✔ Home improvements

✔ Debt consolidation

✔ Large expenses with lower interest

How they work:

You borrow against your home’s equity:

- Home Equity Loan: fixed amount + fixed rate

- HELOC: revolving line of credit (like a credit card)

Pros:

- Lower interest rates than personal loans

- Large borrowing power

Cons:

- Home used as collateral

- Risk of foreclosure if you default

7. Payday & Short-Term Loans

Best for:

✔ Emergency cash (only as a last resort)

How they work:

These loans offer fast cash with extremely high interest (sometimes 300%+ APR). They must be repaid quickly—often by your next paycheck.

Pros:

- Instant access to money

- No credit check

Cons:

- Very high fees and interest

- Can lead to debt cycles

How to Choose the Right Loan

Here’s a simple decision framework:

1. What do you need the money for?

- Home? → Mortgage

- Car? → Auto loan

- Education? → Student loan

- General expenses? → Personal loan

2. Do you have collateral?

- Yes → mortgage, auto loan, home equity

- No → personal loan, federal student loans

3. What’s your credit score?

- High score → better rates, more options

- Low score → secured loans or credit-builder strategies

4. How fast do you need the money?

- Urgent → personal loans or (carefully) short-term loans

- Not urgent → mortgages, auto loans, student loans

5. How much can you afford monthly?

Always calculate your total loan cost, not just the monthly payment.

Quick Summary Table

| Loan Type | Secured? | Best For | Interest Levels | Risk |

|---|---|---|---|---|

| Personal | No | General use | Medium–High | Lower |

| Auto | Yes | Car purchase | Low–Medium | Repossession |

| Mortgage | Yes | Home purchase | Low | Foreclosure |

| Student | Usually No | Education | Low–Medium | Long-term debt |

| Business | Depends | Business funding | Medium | Business liability |

| Home Equity | Yes | Home improvement, big expenses | Low | Home risk |

| Payday | No | Emergency only | Very High | Debt trap |

Final Thoughts

Each loan exists for a purpose, and choosing the right one depends on your financial goals, credit profile, and how quickly you need the funds.

When used wisely, loans can help you grow—buy a home, advance your education, or strengthen your business.

When used carelessly, they can create long-term financial stress.

If you compare options, understand the costs, and borrow responsibly, you’ll always choose the right loan for your situation.