When you’re considering borrowing money, one of the first choices you’ll face is whether to apply for a secured or unsecured loan.

Both have advantages — but the better option depends on your credit, income, goals, and how much risk you’re comfortable taking.

This guide breaks everything down clearly so you can choose the right loan confidently.

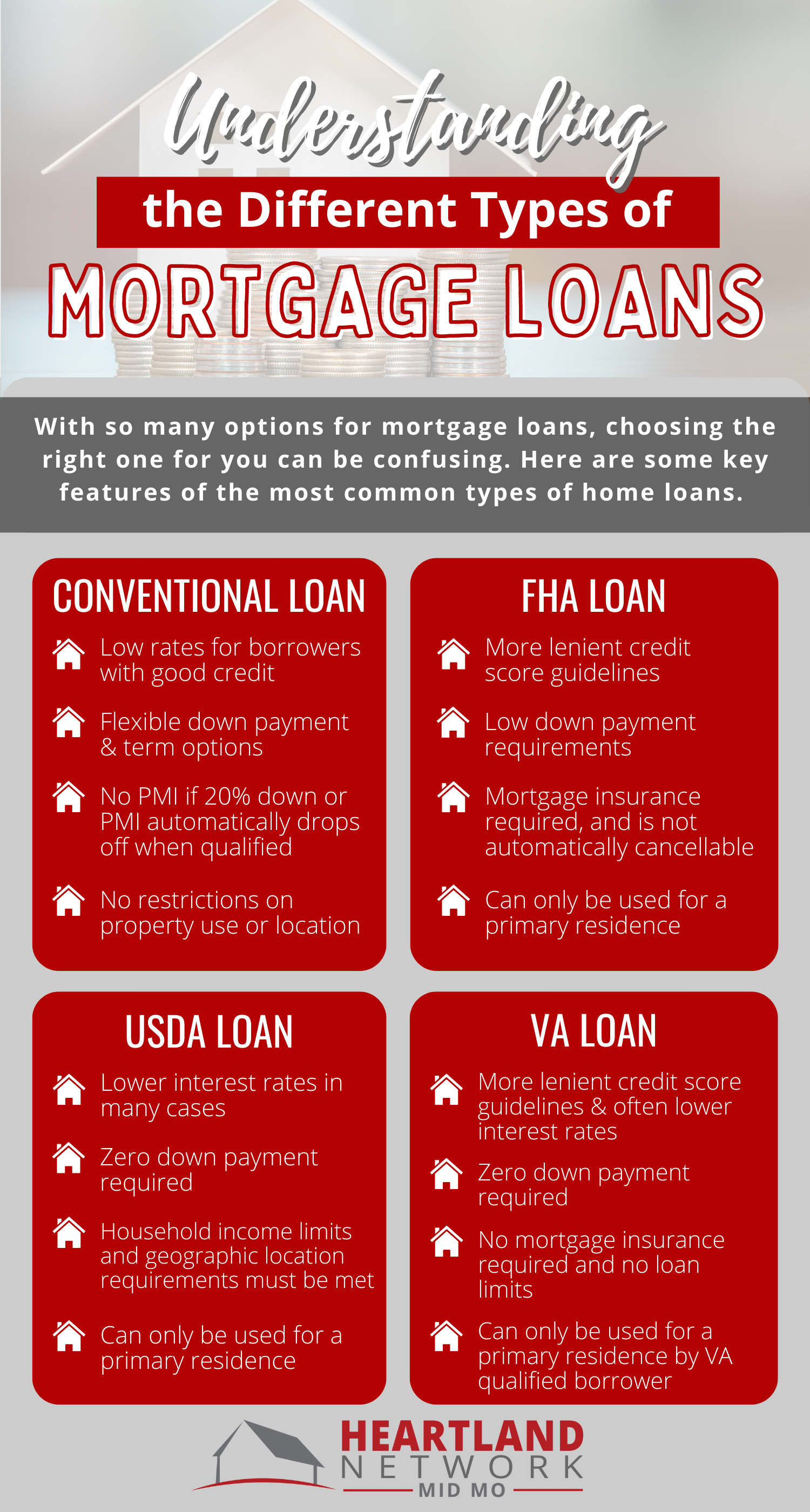

What Is a Secured Loan?

A secured loan is backed by collateral — something valuable you own that the lender can take if you don’t repay.

Common types of secured loans:

- Mortgages (home = collateral)

- Auto loans (car = collateral)

- Home equity loans/HELOCs

- Secured personal loans

How secured loans work:

You pledge an asset → The lender offers lower rates → If you fail to pay, the lender can repossess or foreclose.

Pros:

- Lower interest rates

- Higher approval chances

- Larger loan amounts

Cons:

- Risk of losing your asset

- Longer approval process

- Collateral appraisal may be required

What Is an Unsecured Loan?

An unsecured loan does not require collateral.

Approval is based mainly on your credit score, income, and financial history.

Common unsecured loans:

- Personal loans

- Credit cards

- Student loans (most federal)

- Small unsecured business loans

How unsecured loans work:

Because there’s no collateral, lenders take on more risk—so rates may be higher.

Pros:

- No risk of losing your assets

- Faster approval time

- Less paperwork

Cons:

- Higher interest rates

- Smaller loan limits

- Requires stronger credit

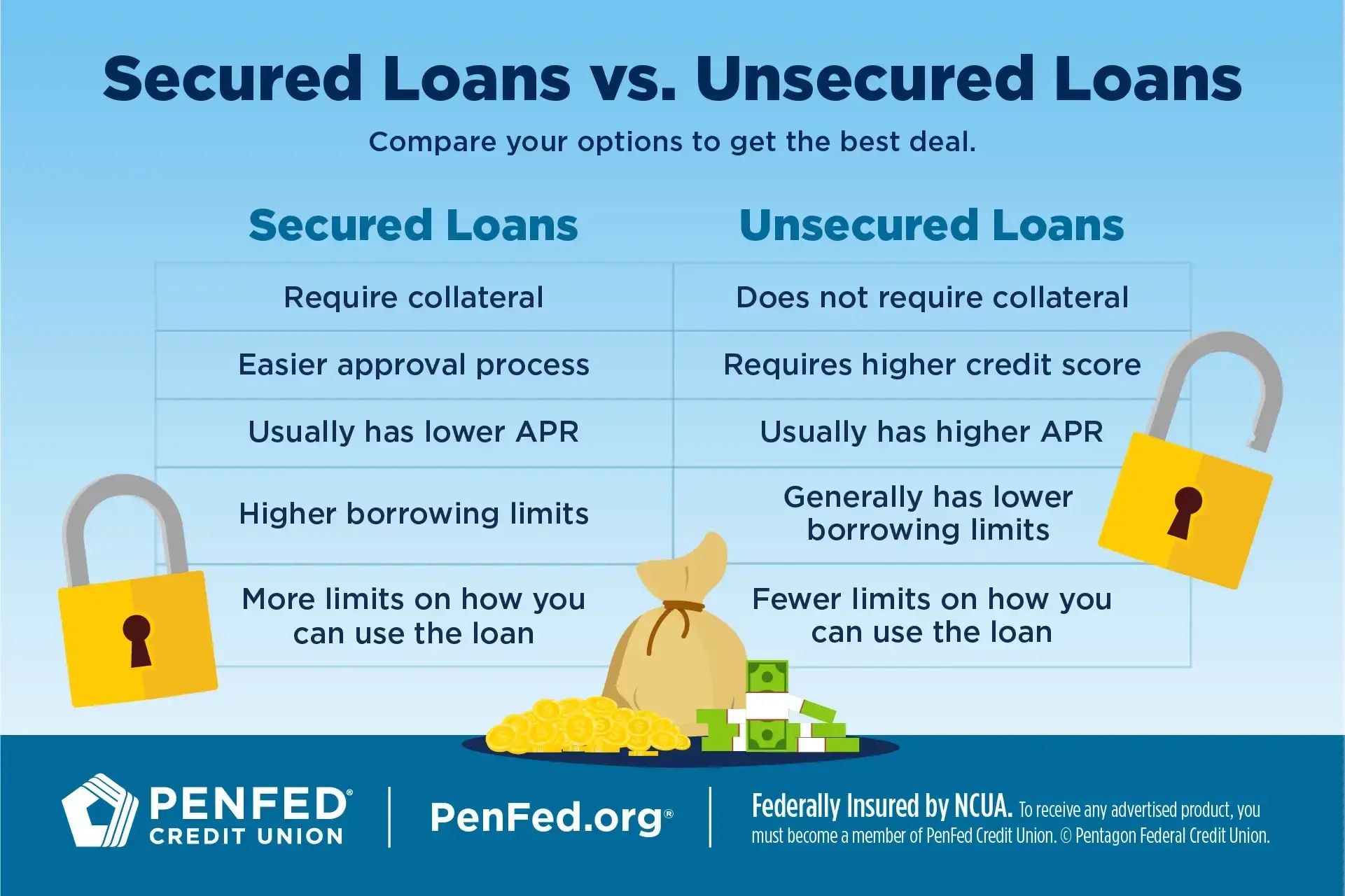

Side-by-Side Comparison

| Feature | Secured Loan | Unsecured Loan |

|---|---|---|

| Collateral Required | Yes | No |

| Interest Rate | Lower | Higher |

| Loan Amount | Higher | Moderate |

| Approval Difficulty | Easier (if you have collateral) | Harder (credit dependent) |

| Risk Level | Asset at risk | No asset risk |

| Approval Speed | Slower | Faster |

| Best For | Big purchases, low credit | Fast cash, good credit |

When a Secured Loan Is Better

Choose a secured loan if:

✔ You need a large amount

Home purchases, cars, and major renovations often require bigger loans.

✔ Your credit isn’t great

Collateral can help you qualify even with less-than-perfect credit.

✔ You want the lowest possible interest rate

Especially useful for long-term loans like mortgages.

Best for:

- Buying a home or car

- Debt consolidation (using home equity)

- Lowering long-term interest costs

When an Unsecured Loan Is Better

Choose an unsecured loan if:

✔ You don’t want to risk losing assets

Your home or car stays safe if you default.

✔ You need money fast

Applications are faster with fewer documents.

✔ You have good to excellent credit

You’ll qualify for better rates and terms.

Best for:

- Emergencies

- Medical expenses

- Travel or events

- Smaller home projects

- Consolidating smaller debts

Key Questions to Decide Which Loan Fits You

1. What’s your credit score?

- High score → Unsecured may be cheaper

- Lower score → Secured loans may give better rates

2. Do you own valuable collateral?

If yes, secured options expand your loan choices.

3. How fast do you need the money?

Unsecured loans are quicker.

4. How much risk can you tolerate?

If losing your home or car is too risky, avoid secured loans.

5. What is the loan for?

- Home → mortgage (secured)

- Car → auto loan (secured)

- General expenses → unsecured personal loan

Final Verdict: Which Loan Is Better?

There’s no one-size-fits-all answer — it depends on your situation:

✅ Choose secured if you want:

- Lower interest

- Higher approval odds

- Larger loan amounts

- Don’t mind using an asset as collateral

✅ Choose unsecured if you want:

- Fast, collateral-free borrowing

- Flexibility

- Simplicity

- No asset risk

Think about your goals, financial stability, and risk comfort to make the best decision.